All Categories

Featured

Table of Contents

Performing swiftly may remain in your best interest. In addition, the most generous plans (sometimes called "assured issue") might not pay a fatality advantage if you pass away of particular illnesses during the very first 2 years of coverage. That's to protect against people from acquiring insurance coverage right away after finding an incurable ailment. This coverage might still cover death from accidents and various other reasons, so study the alternatives readily available to you.

When you assist reduce the monetary worry, friends and family can concentrate on taking care of themselves and organizing a purposeful memorial as opposed to scrambling to locate money. With this kind of insurance, your beneficiaries may not owe tax obligations on the death advantage, and the cash can approach whatever they require the majority of.

Out Insurance Funeral Cover

for customized whole life insurance coverage Please wait while we recover details for you. To discover the products that are available please telephone call 1-800-589-0929. Adjustment Place

At some point, we all need to think of exactly how we'll pay for a liked one's, and even our own, end-of-life costs. When you sell last expenditure insurance, you can offer your customers with the satisfaction that includes understanding they and their families are planned for the future. You can additionally profit from a substantial possibility to optimize your book of business and develop a charitable brand-new earnings stream! Ready to learn everything you require to recognize to start marketing final expense insurance efficiently? No one likes to think of their very own death, but the truth of the issue is funerals and interments aren't affordable (funeral final expense insurance).

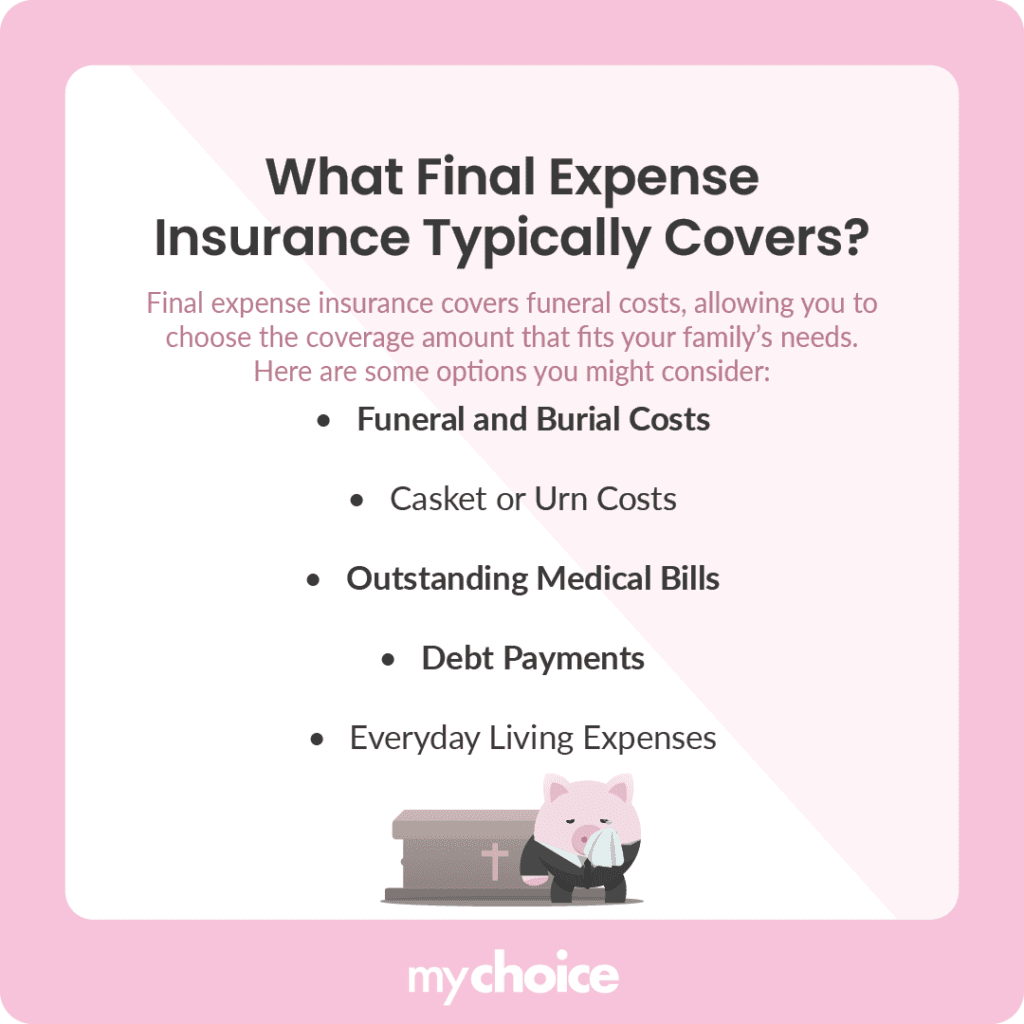

As opposed to giving revenue replacement for enjoyed ones (like most life insurance coverage policies do), last expense insurance policy is implied to cover the prices connected with the policyholder's watching, funeral service, and cremation or interment. Legally, however, beneficiaries can often utilize the policy's payment to pay for anything they desire. Usually, this type of policy is released to people ages 50 to 85, however it can be issued to more youthful or older people.

There are four primary types of last expense insurance: ensured problem, graded, modified, and degree (chosen or common score). We'll go a lot more right into information about each of these item types, however you can obtain a quick understanding of the differences between them by means of the table below. Exact benefits and payout schedules might differ depending on the service provider, strategy, and state.

Senior Funeral Plan

You're assured insurance coverage however at the greatest price. Typically, ensured issue last expenditure strategies are released to customers with severe or numerous wellness concerns that would prevent them from protecting insurance at a common or graded rating. funeral expenses insurance uk. These health and wellness problems may consist of (yet aren't restricted to) kidney illness, HIV/AIDS, body organ transplant, energetic cancer treatments, and ailments that restrict life expectations

Furthermore, clients for this sort of strategy could have severe lawful or criminal backgrounds. It is essential to keep in mind that different service providers offer a variety of issue ages on their ensured problem plans as low as age 40 or as high as age 80. Some will also provide greater stated value, approximately $40,000, and others will certainly permit better death benefit conditions by boosting the rate of interest with the return of costs or decreasing the variety of years until a complete survivor benefit is offered.

If non-accidental fatality takes place in year 2, the service provider could just pay 70 percent of the fatality benefit. For a non-accidental death in year 3 or later on, the service provider would possibly pay one hundred percent of the death advantage. Changed final cost plans, comparable to graded plans, take a look at wellness conditions that would put your client in a much more limiting changed strategy.

Some products have details wellness issues that will certainly obtain special therapy from the provider. As an example, there are providers that will certainly release plans to more youthful grownups in their 20s or 30s that could have chronic problems like diabetes mellitus. Usually, level-benefit standard last cost or simplified problem entire life strategies have the least expensive costs and the largest accessibility of added cyclists that customers can include in policies.

Bereavement Insurance

Depending upon the insurance carrier, both a recommended rate course and standard rate class may be provided - best burial insurance. A customer in exceptional health without any current prescription drugs or wellness conditions might receive a favored price course with the most affordable premiums possible. A client in excellent health and wellness despite having a couple of maintenance medicines, but no considerable health and wellness issues might receive common prices

Similar to various other life insurance policy policies, if your customers smoke, make use of various other forms of tobacco or pure nicotine, have pre-existing health conditions, or are male, they'll likely have to pay a greater price for a last cost policy. In addition, the older your customer is, the greater their rate for a plan will certainly be, since insurance provider think they're tackling more threat when they use to guarantee older clients.

Funeral Advantage Insurance Reviews

The plan will also stay in force as long as the insurance policy holder pays their premium(s). While many various other life insurance policy policies may need clinical examinations, parameds, and participating in doctor declarations (APSs), final expense insurance policy plans do not.

To put it simply, there's little to no underwriting required! That being said, there are two major sorts of underwriting for final expenditure plans: simplified issue and ensured issue (sell final expense over the phone). With simplified issue strategies, clients normally just need to address a couple of medical-related questions and might be refuted coverage by the carrier based upon those solutions

End Of Life Insurance Plans

For one, this can enable representatives to find out what sort of strategy underwriting would certainly work best for a particular customer. And two, it aids agents limit their client's options. Some carriers may invalidate clients for protection based on what medicines they're taking and just how long or why they have actually been taking them (i.e., maintenance or therapy).

The brief response is no. A final expense life insurance policy policy is a type of long-term life insurance policy policy - best final expense insurance company to work for. This means you're covered until you die, as long as you have actually paid all your costs. While this policy is made to help your beneficiary spend for end-of-life costs, they are complimentary to make use of the survivor benefit for anything they require.

Much like any type of various other long-term life policy, you'll pay a regular costs for a last cost plan in exchange for an agreed-upon death benefit at the end of your life. Each service provider has different regulations and options, but it's relatively simple to manage as your beneficiaries will certainly have a clear understanding of how to invest the cash.

You may not require this kind of life insurance policy. If you have irreversible life insurance policy in position your last expenses may already be covered. And, if you have a term life plan, you may be able to convert it to an irreversible plan without several of the extra actions of getting last cost insurance coverage.

Preneed Life Insurance

Made to cover restricted insurance requirements, this type of insurance coverage can be an inexpensive choice for individuals that just wish to cover funeral prices. Some plans may have limitations, so it is essential to check out the small print to make sure the plan fits your demand. Yes, of training course. If you're trying to find a permanent option, universal life (UL) insurance remains in place for your whole life, so long as you pay your costs. family first life final expense.

This option to last expense protection supplies alternatives for added family coverage when you require it and a smaller sized protection quantity when you're older.

Neither is the thought of leaving liked ones with unanticipated expenditures or financial obligations after you're gone. Take into consideration these 5 truths regarding final expenses and just how life insurance policy can aid pay for them.

Latest Posts

Low Cost Burial Insurance

Funeral Cover Quote Online

Difference Between Pre Need And Life Insurance